Compare Medicare Advantage vs. Medicare Supplement Plans

It’s critical to choose the right health insurance. When it comes to additional Medicare coverage, you can choose between Medicare Advantage and Medicare Supplements (you can’t have both). Then, there are many types of Medicare Advantage plans, and there are many different supplement plans. An agent at Sannes Insurance can walk you through your options and help you choose the right plan for your situation.

What’s the Difference?

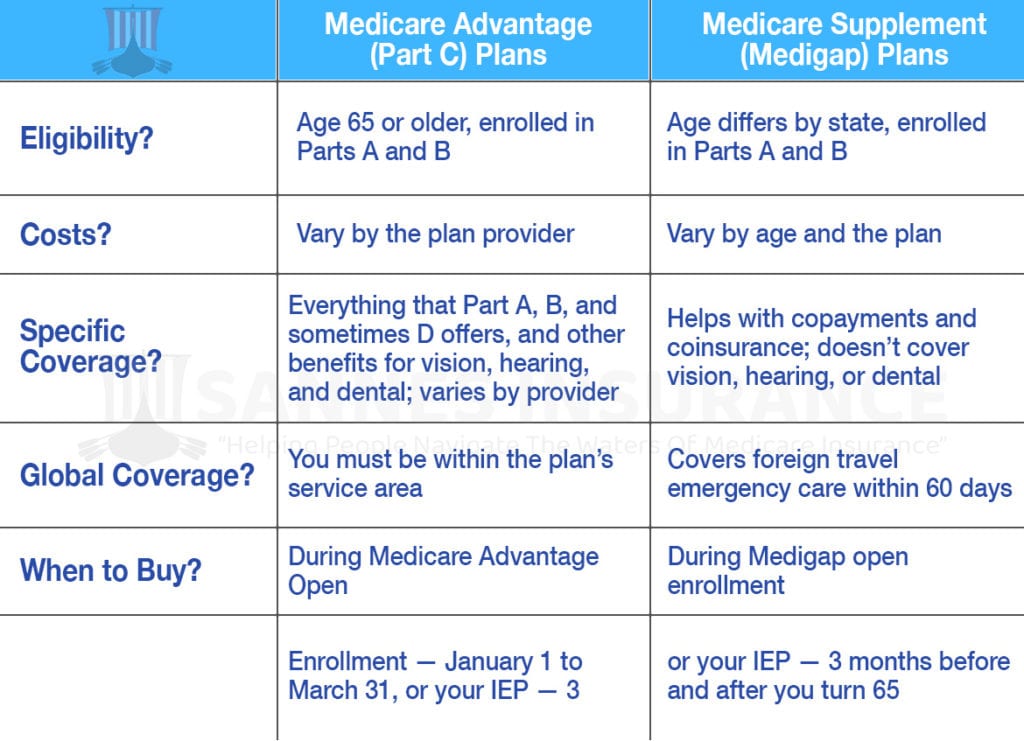

Both Medicare Advantage and Medicare Supplement plans join with your Part A and Part B, offering coverage that Original Medicare leaves behind. However, they’re not the same thing.

Medicare Advantage (Part C) is an alternative to Original Medicare. Private carriers offer the plans, which cover your Part A, B, and often D plans, plus other benefits.

Medicare Supplements (Medigap) are another group of plans that help pay for out-of-pocket costs like copays, deductibles, and coinsurance. You can purchase Medigap in addition to your Part A, B, or D plan. It doesn’t “replace” Original Medicare.

When Medicare Advantage May Work for You

A Medicare Advantage plan may suit you if:

- You already have Parts A, B, and D

- You want additional benefits like vision, hearing, and dental

- You’d rather have an “all-in-one” plan for your healthcare needs

- You have an approved provider that you like, and you know they take Medicare Advantage plans

Note: The requirements for approved providers change every year. Also, you must live in the plan’s coverage area to get benefits, except for emergencies.

When Medicare Supplements May Work for You

On the flipside, a Medicare Supplement plan may suit you better if:

- You need help with out-of-pocket expenses

- You already have vision, hearing, or dental insurance

- You plan to travel abroad and want to prepare for the unexpected

- You prefer to pick the coverage amount for out-of-pocket costs you’re buying

Note: A carrier can’t sell you a Medigap policy if you already have a Medicare Advantage plan. Also, if you need coverage for extended hospice or long-term care, supplement insurance may not be a good fit for you.

Sannes Insurance Can Help

Your choice of a Medicare plan will depend on your unique needs. Good news. There’s a plan out there for you — no matter your age or health status. And you don’t have to decide alone. Call at 509-993-9887 or contact an insurance agent online.